The Abolition of MPF Offsetting Arrangement

The Government has announced that the abolition of offsetting arrangement takes effect on 1 May 2025.

According to the existing Employment Ordinance (EO), the calculation of SP/LSP for monthly rated employees* is two-thirds of the last full month’s wages before termination of employment, subject to a monthly wage ceiling of $22,500, for each year of service; and the maximum payment of SP/LSP is $390,000. The calculation and ceiling of SP/LSP will remain unchanged after the abolition.

* An employee may also select to use his/her average wages in the 12 months before the termination of employment for the calculation. For daily-rated/ piece-rated employee, he/she may select any 18 days’ wages out of his/her last 30 normal working days or 18 times of average daily wages before termination of employment, and the sum should not exceed 2/3 of $22,500 (i.e. $15,000).

-

(1) If an employee’s employment commences on or after 1 May 2025 (“transition date”)

The employee’s SP/LSP will all belong to years of service on or after the “transition date”. The calculation will be the same as the existing provisions of EO and remain unchanged. -

(2) If an employee’s employment commences before 1 May 2025 (“transition date”)

The employee’s SP/LSP will be divided by the “transition date” into pre-transition portion and post-transition portion.

Pre-transition portion:

-

The last full month’s wages immediately preceding the “transition date” × 2/3 × years of service before the “transition date”

Post-transition portion:

-

The last full month’s wages before termination of employment × 2/3 × years of service starting from the “transition date”

Example

Assumptions –

-

Years of service before the “transition date”: 4 years

-

Years of service starting from the “transition date”: 3 years

-

Last month’s wages immediately preceding the “transition date”: $15,000

-

Last month’s wages before termination of employment: $18,000

Calculation of SP/LSP:

|

Pre-transition portion

of SP/LSP |

$40,000 ($15,000 × 2/3 × 4 years) |

|

Post-transition portion

of SP/LSP |

$36,000 ($18,000 × 2/3 × 3 years) |

| Total amount of SP/LSP | $76,000 ($40,000 + $36,000) |

The existing entitlement to SP/ LSP under EO remains unchanged after the abolition. Dividing an employee’s employment period into pre-transition employment period and post-transition employment period is only for the sake of calculating his/her pre-transition and post-transition portion of SP/LSP. This will not affect the employee’s entitlement to SP/ LSP.

Example

Assumptions –

-

Years of service before the “transition date”: 6 months

-

Years of service starting from the “transition date”: 5 years

-

Last month’s wages immediately preceding the “transition date”: $15,000

-

Last month’s wages before termination of employment: $18,000

The employee’s years of service is 5 years and 6 months, and the calculation of SP/LSP is as follows:

|

Pre-transition portion

of SP/LSP |

$5,000 ($15,000 × 2/3 × 0.5 year) |

|

Post-transition portion

of SP/LSP |

$60,000 ($18,000 × 2/3 × 5 years) |

| Total amount of SP/LSP | $65,000 ($5,000 + $60,000) |

If the employment period before the “transition date” of a monthly-rated employee is less than 1 month, his/her pre-transition portion of SP/ LSP is calculated using the first full month’s wages after commencement of employment. For daily-rated/ piece-rated employee whose employment period before the “transition date” is less than 30 normal working days, his/her pre-transition portion of SP/ LSP is calculated using the sum of any 18 days’ wages chosen out of the first 30 normal working days after commencement of employment.

If the total SP/LSP (i.e. the aggregate sum of pre-transition and post-transition portions of SP/LSP) of an employee exceeds the maximum payment of $390,000 as stipulated in EO, the amount in excess will be deducted from the post-transition portion.

In other words,

-

the amount of pre-transition portion of SP/LSP remains unchanged (subject to a maximum of $390,000);

-

the amount of post-transition portion of SP/LSP will be the remainder of $390,000 minus the amount of pre-transition portion.

Example

Assumptions –

-

Years of service before the “transition date”: 20 years

-

Years of service starting from the “transition date”: 10 years

-

Last month’s wages immediately preceding the “transition date”: $22,500

-

Last month’s wages before termination of employment: $30,000

Calculation of SP/LSP:

|

Pre-transition portion

of SP/LSP |

$300,000 ($22,500 × 2/3 × 20 years) |

|

Post-transition portion

of SP/LSP |

$150,000 ($22,500* × 2/3 × 10 years)

Since the total amount of SP/LSP exceeds $390,000 (pre-transition portion $300,000 + post-transition portion $150,000 = $450,000), the amount of post-transition portion of SP/LSP should be the remainder of $390,000 minus the amount of pre-transition portion of SP/LSP - $90,000 ($390,000 - $300,000) |

| Total amount of SP/LSP |

$390,000 (pre-transition portion $300,000 + post-transition portion $90,000) |

* The ceiling of the monthly wages for calculating SP/LSP is $22,500.

Before the abolition, the accrued benefits derived from employer’s MPF contributions (including mandatory and voluntary contributions) as well as gratuities based on employees’ years of service can be used for offsetting an employee’s SP/LSP.

Accrued benefits derived from employers’ mandatory MPF contributions (ERMC)

After the abolition, employers can no longer use ERMC to offset an employee’s SP/ LSP in respect of the employment period starting from the “transition date” (i.e. the post-transition portion).

The abolition has no retrospective effect. If an employee commences employment before the “transition date”, employers can continue to use the accrued benefits derived from their MPF contributions (irrespective of the contributions made before, on or after the “transition date”, and irrespective of mandatory or voluntary contributions) to offset SP/LSP in respect of the employment period before the “transition date” (i.e. the pre-transition portion).

Example

Assumptions –

-

Years of service before the “transition date”: 4 years

-

Years of service starting from the “transition date”: 3 years

-

Last month’s wages immediately preceding the “transition date”: $15,000

-

Last month’s wages before termination of employment: $18,000

-

ERMC: $68,400 (assuming the employee has been given wage increase once only during the 7-year employment, which takes effect on the “transition date”, and ERMC has no profit/loss)

Calculation of SP/LSP with offsetting arrangement:

|

SP/LSP of the employee

Total: |

$76,000 |

|

ERMC

(can offset pre-transition portion of SP/LSP only) |

$68,400 |

| ERMC for offsetting pre-transition portion of SP/LSP | $40,000 |

| ERMC retained in the employee’s MPF account | $28,400 |

| Remaining SP/LSP payable by the employer after offsetting | $36,000 |

| Aggregate benefits of the employee |

$104,000 ($76,000 SP/LSP + $28,400 ERMC retained in the employee’s MPF account) |

Accrued benefits derived from employer’s voluntary MPF contributions (ERVC)

ERVC can continue be used for offsetting employee’s SP/LSP (irrespective of pre-transition or post-transition portion).

Gratuities based on years of service

Employers can continue to use gratuities based on employee’s years of service for offsetting employee’s SP/LSP (irrespective of pre-transition or post-transition portion).

After the abolition, the aggregate benefits (i.e. SP/LSP and ERMC in their MPF accounts) received by the vast majority of employees, including employees with long years of service, will be higher than that under the current offsetting regime. Employers can no longer use ERMC to offset employees’ post-transition portion of SP/LSP, thereby employees can retain more MPF accrued benefits for retirement protection.

For those employees whose SP/ LSP has already reached the maximum amount before the “transition date”, the aggregate benefits received by them after the abolition would not be less than that under the current offsetting regime.

For those employees whose employment commences after the “transition date”, the aggregate benefits (i.e. SP/LSP and ERMC in their MPF accounts) received by them after the abolition would not be less than that under the current offsetting regime.

For those employees whose employment commences before the “transition date”, the aggregate benefits received by them after the abolition would generally be higher than that under the current offsetting regime.

Under special circumstances, the aggregate benefits received by employees after the abolition might be less than that under the current offsetting regime, for example: (a) the employee has a substantial pay rise after the “transition date” and thus the wage rate for calculating pre-transition portion of SP/LSP (i.e. the monthly wages immediately preceding the “transition date”) would have a greater disparity when comparing with existing calculation; (b) the pre-transition employment period is long, and thus the above has greater impacts ; and (c) the post-transition employment period is short, and thus the employee’s benefits gained from the abolition are relatively small. The Government anticipated that there will not be many such cases and their number would gradually decrease when the post-transition employment period of employees is getting longer and fewer employees would have employment period straddling across the “transition date”.

The Government will make up for the shortfall should any such case arise so as to ensure that no employee would be worse off due to policy change.

To reduce the risk of dismissal before the “transition date”, the abolition will have no retrospective effect. The following arrangements will be put in place in respect of the pre-transition portion of SP/LSP of employees whose employment commences before the “transition date”:

- Pre-transition portion of SP/LSP will be calculated on the basis of the wage rate as at the “transition date” instead of that at the termination of employment. As such, regardless of any increase in salary or when the employment is terminated after “transition date”, the amount of pre-transition portion of SP/LSP would not increase; and

- For employees who leave employment after the “transition date”, employers can continue to use ERMC to offset employees’ pre-transition portion of SP/LSP.

Therefore, employers dismissing existing employees before the “transition date” will not save SP/LSP expenses.

Generally speaking, employers dismissing existing employees and hiring new employees will, in the contrary, incur higher SP/LSP expenses. The ERMC in respect of the existing employees’ whole employment period can continue to be used to offset their pre-transition portion of SP/LSP. Therefore, retaining existing employees allows ERMC to grow, which can be used to offset pre-transition portion of SP/LSP in future.

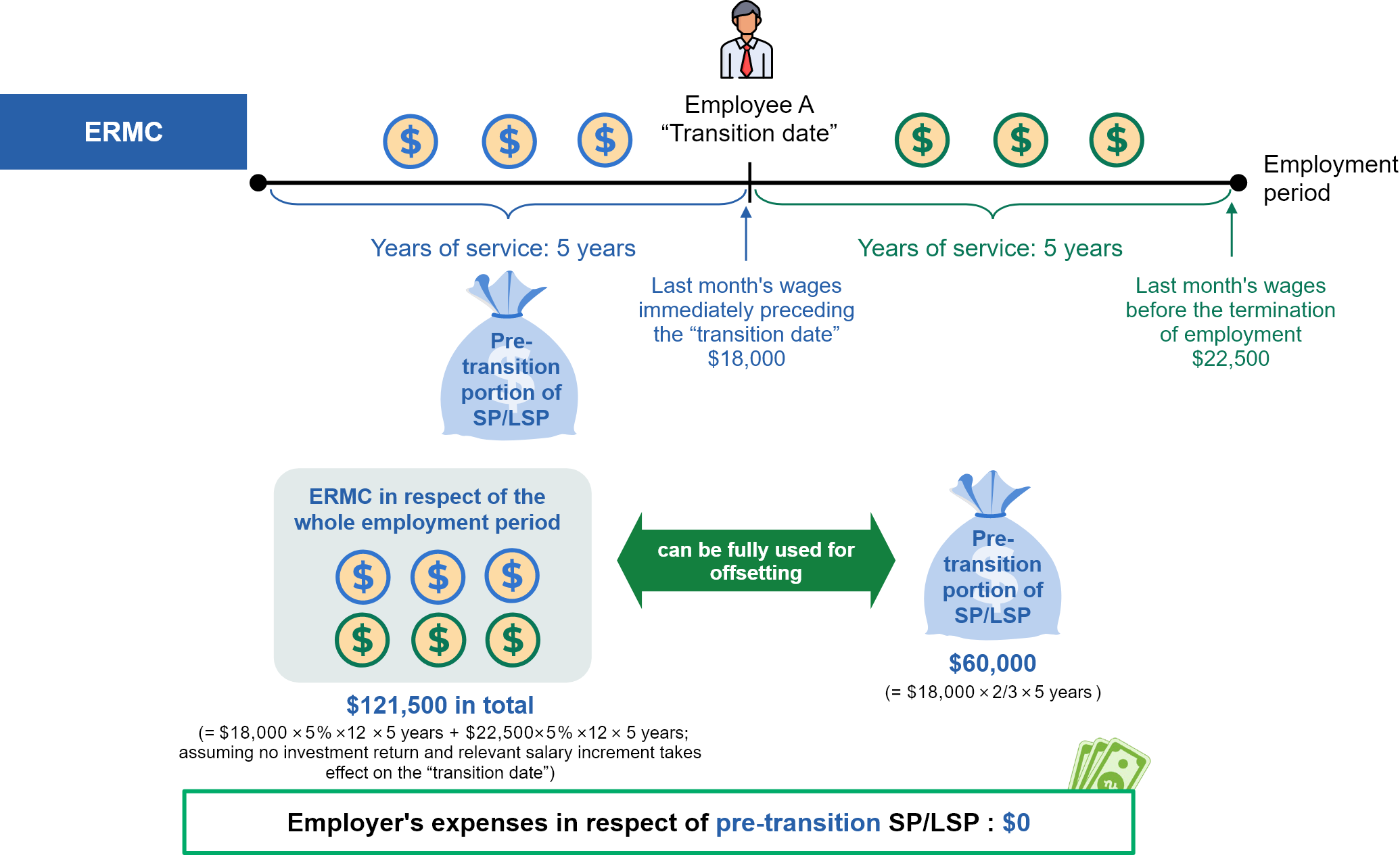

Example 1

Scenario 1: Employer continues to employ an existing employee after the “transition date”

Assuming an employer employs Employee A for 5 years before the “transition date” and continues to employ Employee A for 5 years after the “transition date”. Assuming the last month’s wages of Employee A immediately preceding the “transition date” is $18,000 whilst the last month’s wages before the termination of employment is $22,500.

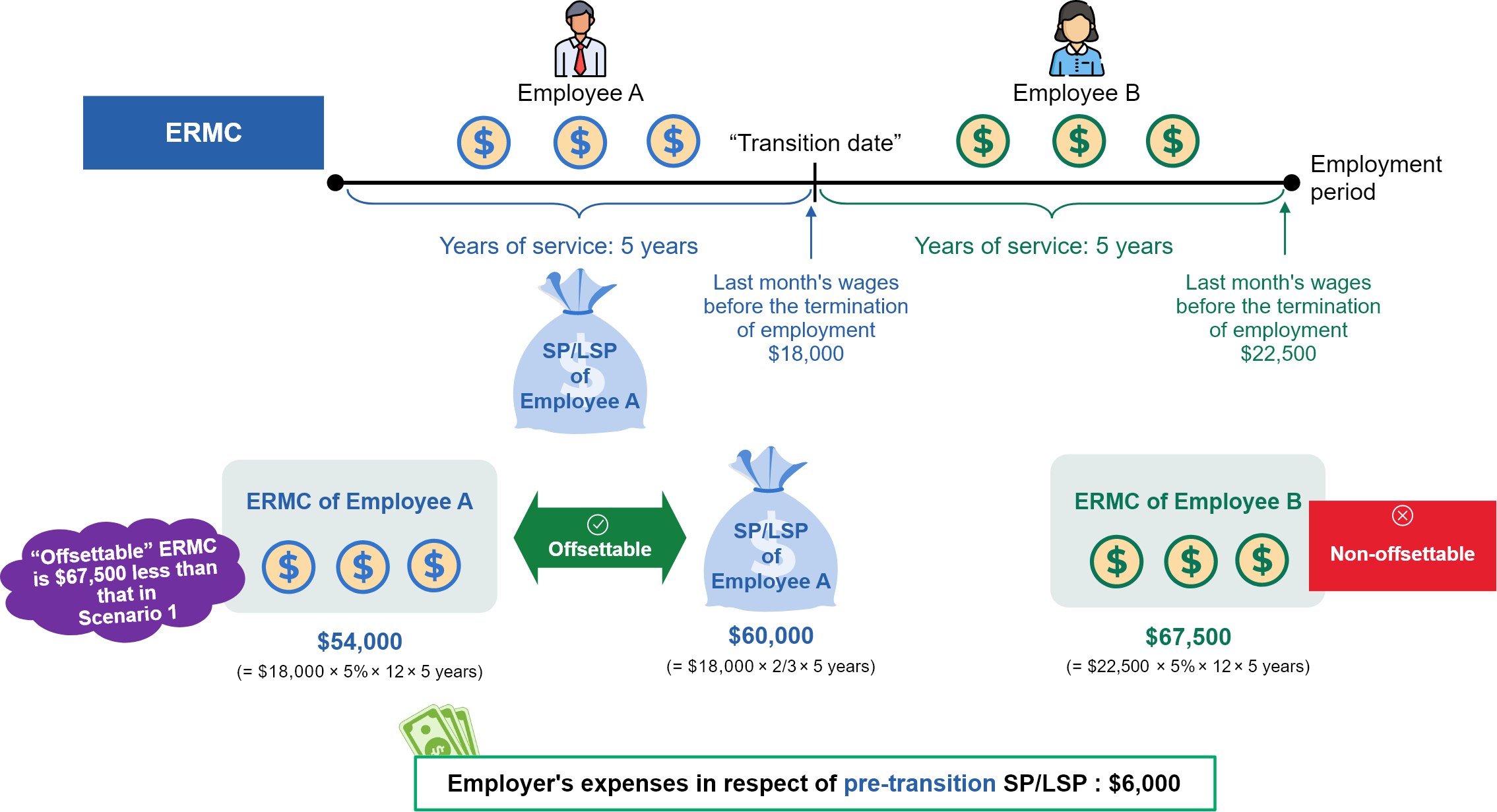

Scenario 2: Employer dismisses an existing employee before the “transition date” and employs a new employee after the transition

Assuming the employer dismisses Employee A who has 5 years of service before the “transition date” and employs a new Employee B for another 5 years. Assuming the last month’s wages of Employee B before the termination of employment is also $22,500.

The above example illustrates that if the employer dismisses an existing employee before the “transition date” and employs a new employee afterwards, an additional amount of $6,000 pre-transition SP/LSP is incurred. No matter the employer continues to employ Employee A or changes to employ Employee B, the amount of post-transition SP/LSP incurred are the same, which is $75,000 and non-offsettable.

Besides, the maximum amount of SP/LSP (i.e. the sum of pre-transition and post-transition portion of SP/LSP) remains $390,000 after the abolition. The amount in excess will be deducted from the post-transition portion.

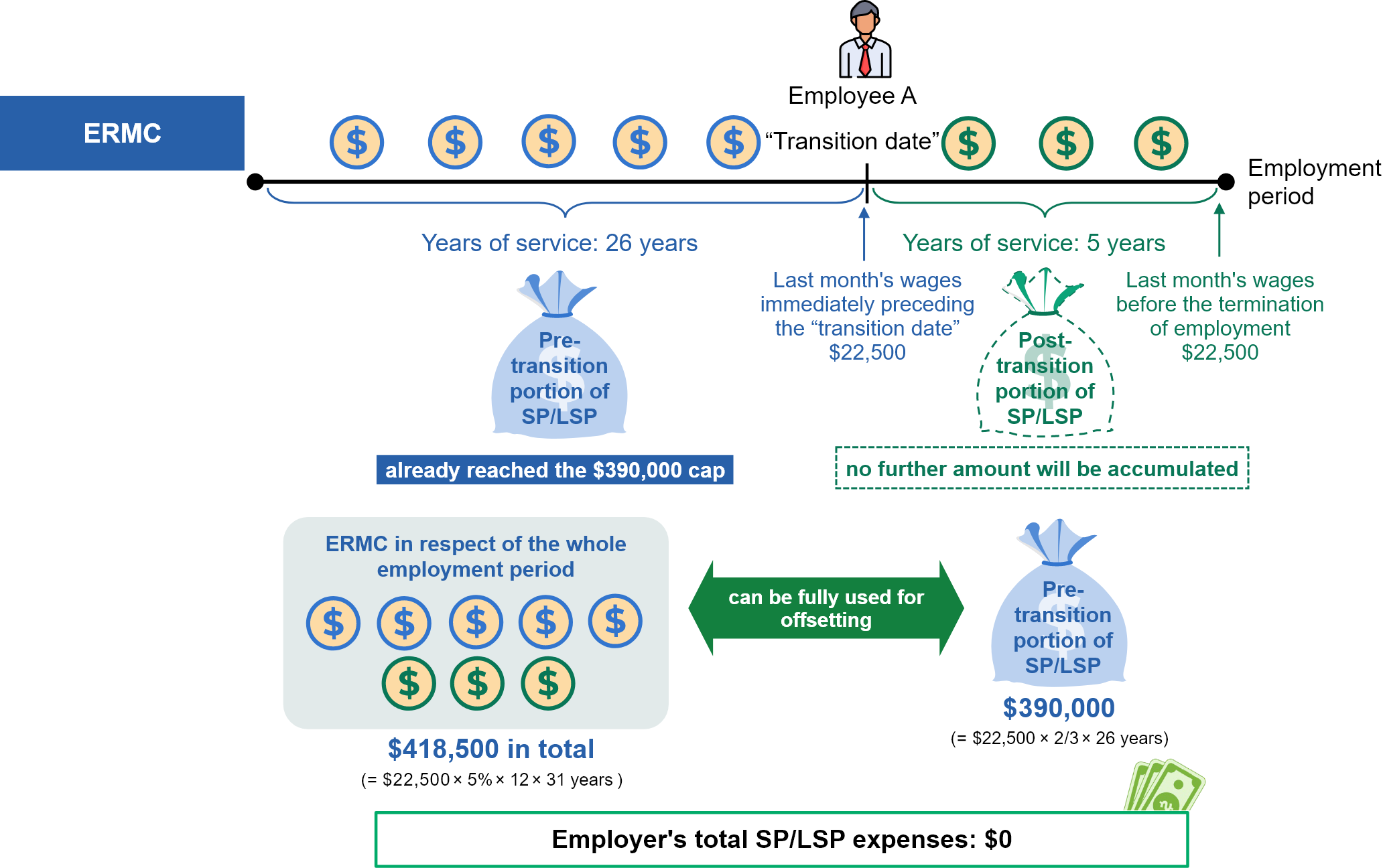

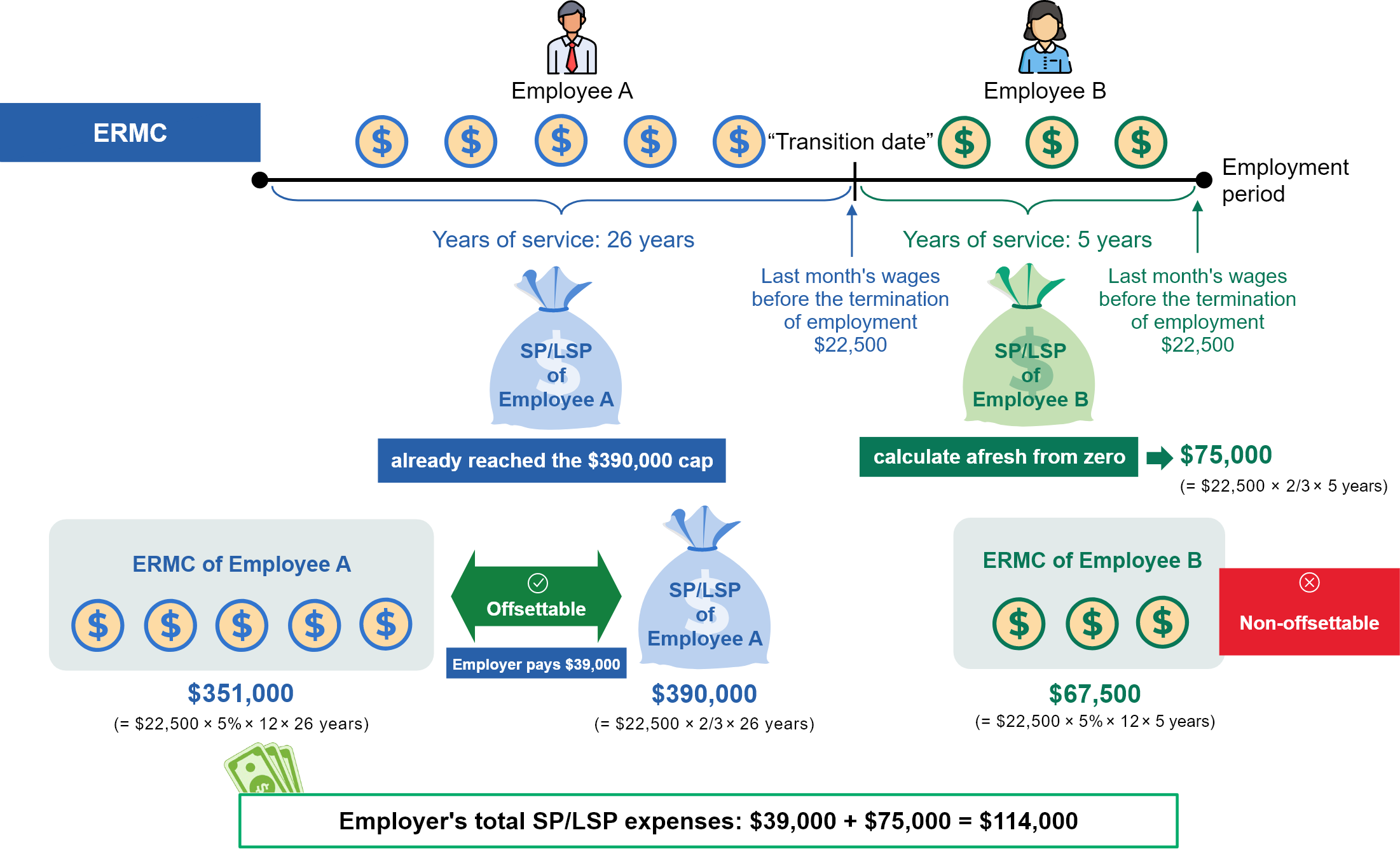

Assuming an employee’s SP/LSP has already exceeded $390,000 before the “transition date”, and the employer continues to hire that employee after the abolition. Since the amount in excess of the cap will be deducted from the post-transition portion, no further post-transition portion of SP/LSP can be accumulated. In other words, his/her SP/LSP entirely belongs to pre-transition portion and can still be offset by ERMC no matter when the employee leave employment after the “transition date”. On the contrary, if the employer dismisses the employee before the abolition and hire a new employee after the “transition date”, the new employee’s SP/ LSP will build up afresh to a maximum of $390,000, and cannot be offset by ERMC. This will instead incur higher SP/LSP expenses for the employer.

Example 2

Scenario 1: Employer continues to employ an existing employee after the “transition date”

Assuming an employer employs Employee A for 26 years before the “transition date” and continues to employ Employee A for 5 years after the “transition date”. Assuming the last month’s wages of Employee A immediately preceding the “transition date” and before the termination of employment are both $22,500.

Scenario 2: Employer dismisses an existing employee before the “transition date” and employs a new employee after the transition

Assuming the employer dismisses Employee A who has 26 years of service before the “transition date” and employs a new Employee B for another 5 years. Assuming the last month’s wages of Employee B before the termination of employment is also $22,500.

The above example illustrates that if the employer dismisses an existing employee before the “transition date” and employs a new employee afterwards, an additional amount of $114,000 SP/LSP is incurred.

The abolition is also applicable to ORS exempted under the Mandatory Provident Funds Schemes Ordinance (MPFSO). Since the employers’ contributions under ORS are not differentiated into mandatory or voluntary portions, a portion of benefits (“carved-out benefits”) must be calculated and carved out from the vested benefits derived from employers’ contributions using the below formula -

Final average monthly relevant income* × Years of service with ORS benefits# × 5% × 12

* Means the employee’s average monthly relevant income in the 12 months immediately preceding the termination of employment, subject to the maximum level of relevant income under MPFSO. The current monthly maximum relevant income level is $30,000.

# Only years of service on or after 1 Dec 2000 will count.

“Carved-out benefits” is akin to the accrued benefits derived from employers’ mandatory MPF contributions, whilst the “remaining benefits”, i.e. the remainder of vested benefits derived from employers’ contributions after carving out the “carved-out benefits”, is akin to the accrued benefits derived from employers’ voluntary MPF contributions.

If an employee commences employment after the “transition date”, the “carved-out benefits” cannot offset SP/LSP, whilst the “remaining benefits” can offset SP/LSP.

If an employee commences employment before the “transition date”, his/her SP/LSP will be divided into the pre-transition portion and the post-transition portion. The “carved-out benefits” can offset pre-transition portion of SP / LSP, whilst the “remaining benefits” can offset pre-transition and/or post-transition portions of SP/LSP.

Example 1

Assuming an employee commences employment after the “transition date” -

-

Years of service: 6 years

-

Last month’s wages before termination of employment: $32,000

-

Final average monthly relevant income: $32,000

-

Vested benefits derived from employer’s ORS contributions: $120,000

Calculation of SP/LSP with offsetting arrangement:

| SP/LSP of the employee | $90,000 ($22,500*× 2/3 × 6 years) |

| “Carved-out benefits” | $108,000 ($30,000# × 6 years × 5% × 12) |

|

“Remaining benefits”

(can offset SP/LSP) |

$12,000 ($120,000 – $108,000) |

| Vested ORS benefits derived from employer’s contributions and retained by the employee | $108,000 |

| Remaining SP/LSP payable by the employer after offsetting | $78,000 ($90,000 – $12,000) |

| Aggregate benefits of employee |

$198,000 ($90,000 SP/LSP + $108,000 vested ORS benefits derived from employer’s contributions and retained by the employee) |

* The ceiling of the monthly wages for calculating SP/LSP is $22,500.

# Final average monthly relevant income is currently capped at $30,000.

Example 2

Assuming an employee commences employment before the “transition date” -

-

Years of service before the “transition date”: 4 years

-

Years of service starting from the “transition date”: 3 years

-

Last month’s wages immediately preceding the “transition date”: $15,000

-

Last month’s wages before termination of employment: $18,000

-

Final average monthly relevant income: $18.000

-

Vested benefits derived from employer’s ORS contributions: $109,440

|

SP/LSP of the employee

Total: |

$76,000 |

|

“Carved-out benefits”

(can offset pre-transition portion of SP/LSP) |

$75,600 ($18,000 × 7 years × 5% × 12) |

|

“Remaining benefits”

(can offset pre-transition and post-transition portions of SP/LSP) |

$33,840 ($109,440 – $75,600) |

|

Vested ORS benefits derived from employer’s contributions and retained by the employee

(i.e. the remaining “carved-out benefits” after offsetting pre-transition portion of SP/LSP) |

$35,600 ($75,600 – $40,000) |

|

Remaining SP/LSP payable by the employer after offsetting

(i.e. the remainder of post-transition portion of SP/LSP after offset by “remaining benefits”) |

$2,160 ($36,000 – $33,840) |

| Aggregate benefits of employee |

$111,600 ($76,000 SP/LSP + $35,600 vested ORS benefits derived from employer’s contributions and retained by the employee) |

The ORS contributions made by the employer for an employee before the implementation of the MPF System on 1 Dec 2000 is voluntary in nature. When calculating the “carved-out benefits”, only those years of service on or after 1 Dec 2000 will count towards the “years of service with ORS benefits”.

Employers can no longer use the ERMC to offset employees’ post-transition portion of SP/LSP after the abolition but can continue to offset pre-transition portion of SP/LSP. The vested benefits derived from employers’ ORS contributions before Dec 2000 are voluntary in nature, which can continue to offset SP/LSP (irrespective of pre-transition portion and/or post-transition portion).

ORS contributions made by employers on top of MPF contributions are voluntary in nature. Such vested benefits can continue to offset the employees’ SP/LSP after the abolition.

Apart from MPF schemes, the abolition will also be applicable to ORS exempted under MPFSO, the two school provident funds regulated by the Grant Schools Provident Fund Rules and Subsidized Schools Provident Fund Rules under Education Ordinance, and overseas ORS of employees from outside Hong Kong which are exempted from the MPF System. The abolition for the above schemes/funds will take effect on the same date as the abolition of the offsetting arrangement for MPF System.

The abolition will not be applicable to employees who are not covered by the MPF System or other statutory retirement schemes (e.g. domestic helpers, and employees below the age of 18 or at the age of 65 or above). Employers of these employees are not required to make MPF contributions throughout the whole employment period. They will not be affected by the abolition and their SP/LSP, if applicable, will continue to be calculated using the last month’s wages or 12-month average wages immediately preceding the termination of employment.

According to the existing EO, employers must at all times keep wage records of each employee covering the period of his/her employment during the preceding 12 months, and the records should be kept for a period of another 6 months after the employee ceases to be employed.

After the abolition, save for the above records, for employees who commences employment before the “transition date”, his/her employer must also keep wage records covering the employee’s employment period during the 12 months immediately preceding the “transition date” until 6 months after the employee ceases to be employed. This can facilitate the calculation of the employee’s pre-transition portion of SP/LSP when necessary.

The abolition has no retrospective effect. The accrued benefits derived from employers’ MPF contributions (irrespective of the contributions made before, on or after the “transition date”, and irrespective of mandatory or voluntary contributions) throughout the employee’s whole employment period can continue to offset pre-transition portion of SP/LSP. As such, the records of the accrued benefits derived from employer’s MPF mandatory contributions before the abolition is not necessary.