Employers’ SP/LSP expenses under the Subsidy Scheme for Abolition of MPF Offsetting Arrangement

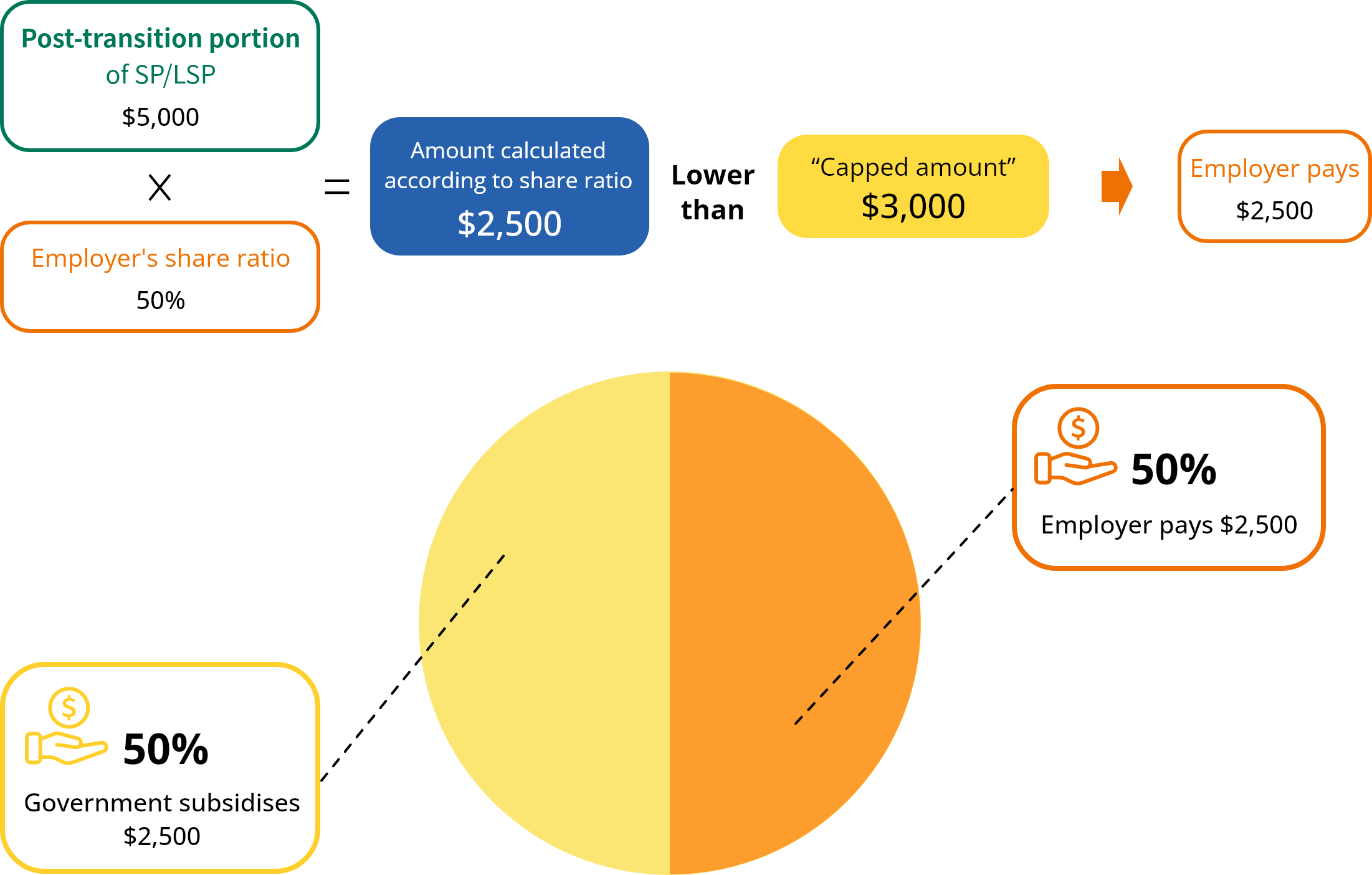

[Example 1]

For cases falling within the $500,000 threshold, if the amount calculated according to the share ratio in Table 1 is higher than the “capped amount”, the employer only needs to pay the “capped amount”.

| Year after the abolition | Employer's share ratio/ “capped amount” in respect of post-transition portion of SP/LSP per employee |

|---|---|

| 1 - 3 | 50% or $3,000(whichever is the lower) |

| 4 | 55% or $25,000(whichever is the lower) |

Assuming in Year 3 after the abolition

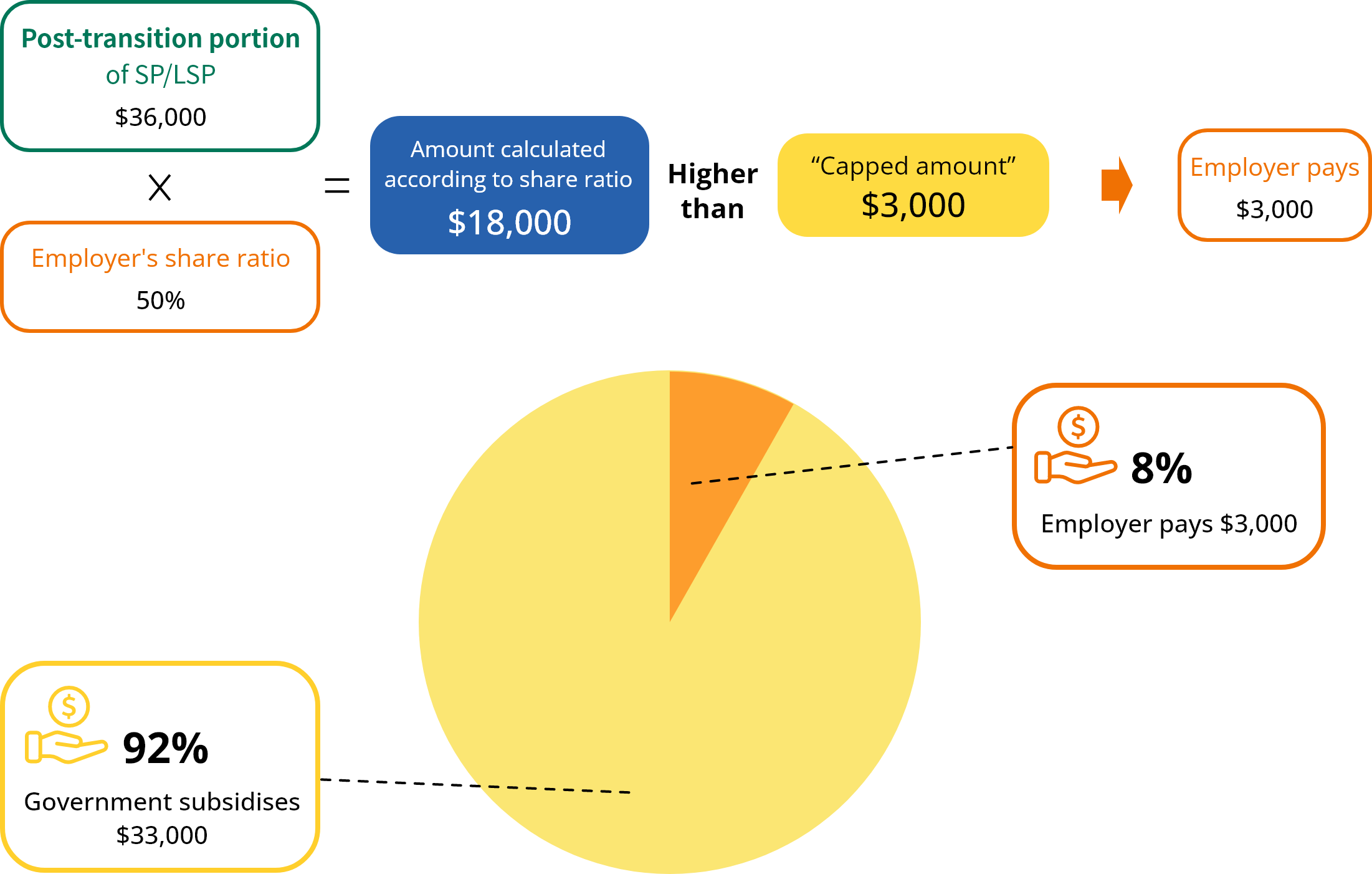

[Example 2]

For cases falling within the $500,000 threshold, if the amount calculated according to the share ratio in Table 1 is less than the “capped amount”, the employer pays according to the share ratio.

| Year after the abolition | Employer's share ratio/ “capped amount” in respect of post-transition portion of SP/LSP per employee |

|---|---|

| 1 - 3 | 50% or $3,000(whichever is the lower) |

| 4 | 55% or $25,000(whichever is the lower) |

Assuming in Year 1 after the abolition

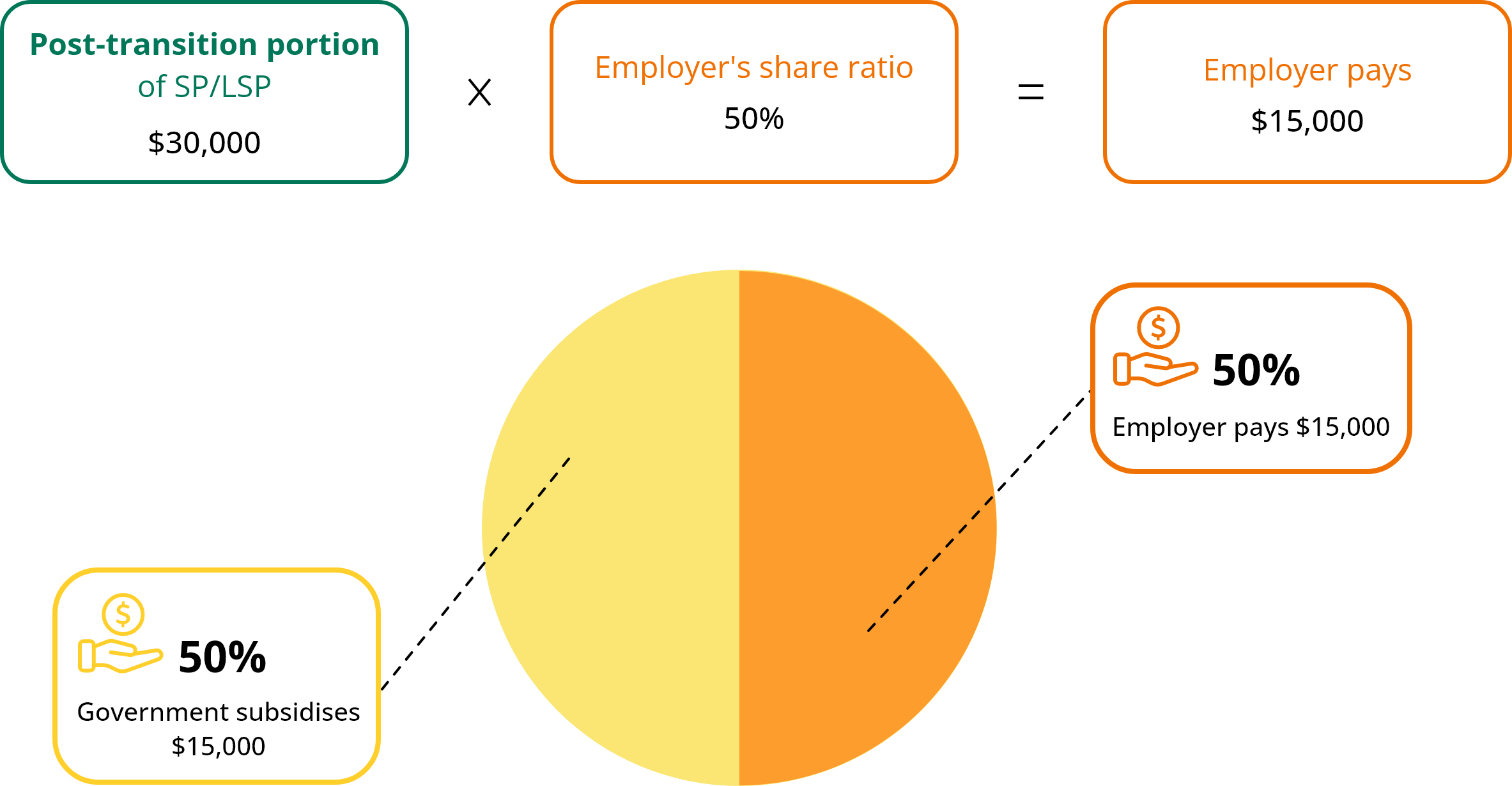

[Example 3]

For cases beyond the $500,000 threshold, the employer shall pay the amount calculated according to the share ratio in Table 2.

| Year after the abolition | Employer's share ratio in respect of post-transition portion of SP/LSP per employee |

|---|---|

| 1 - 3 | 50% |

| 4 | 55% |

Assuming in Year 2 after the abolition