-

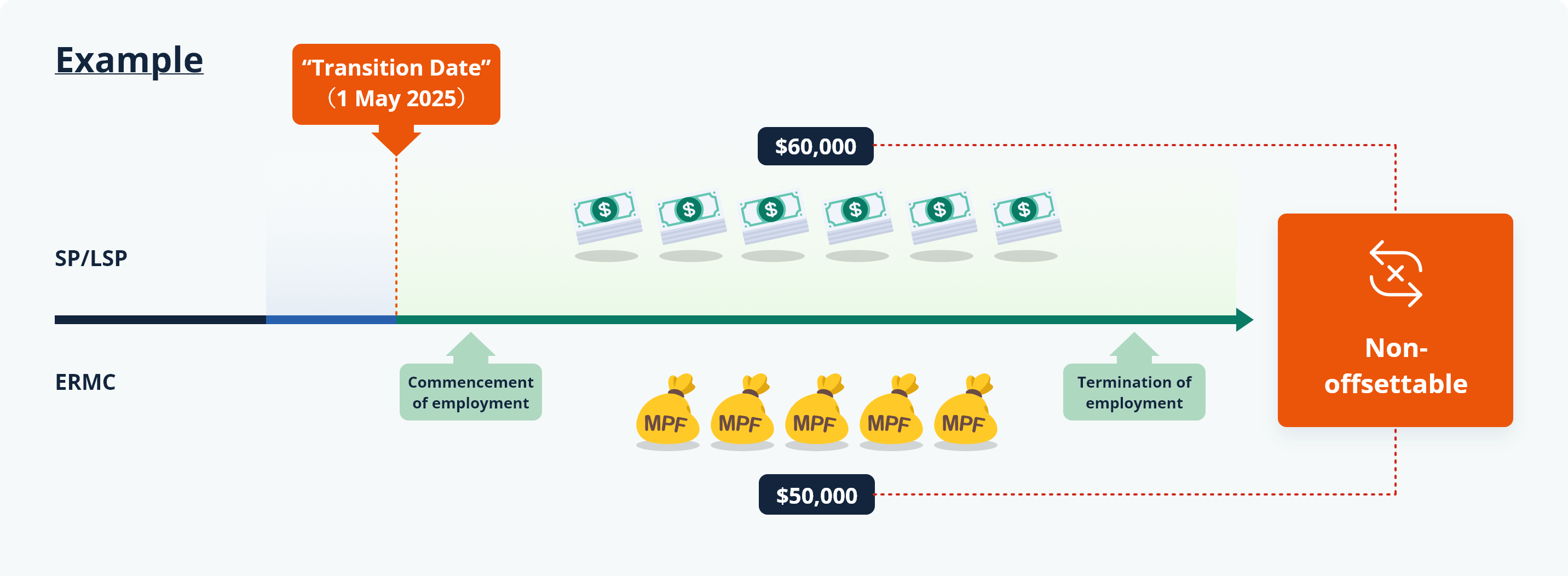

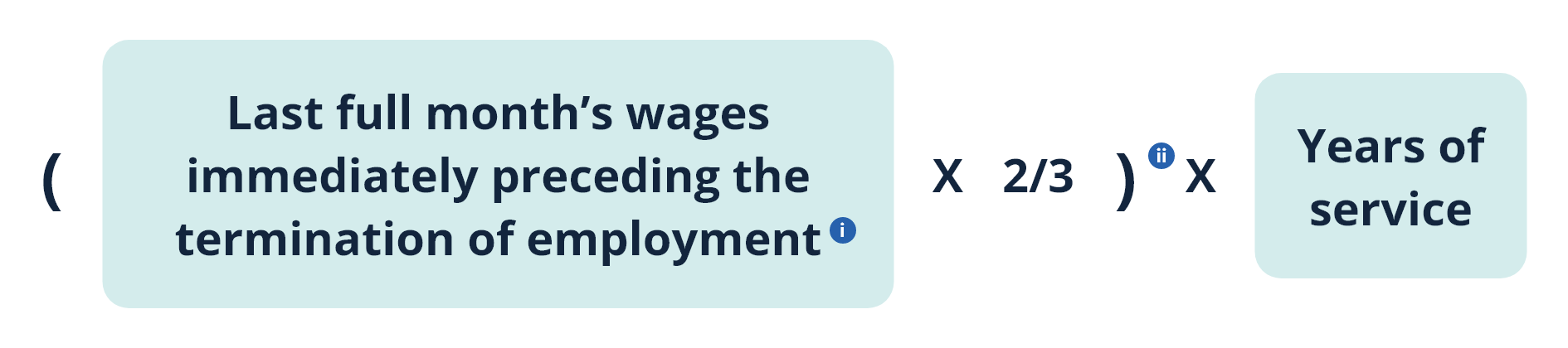

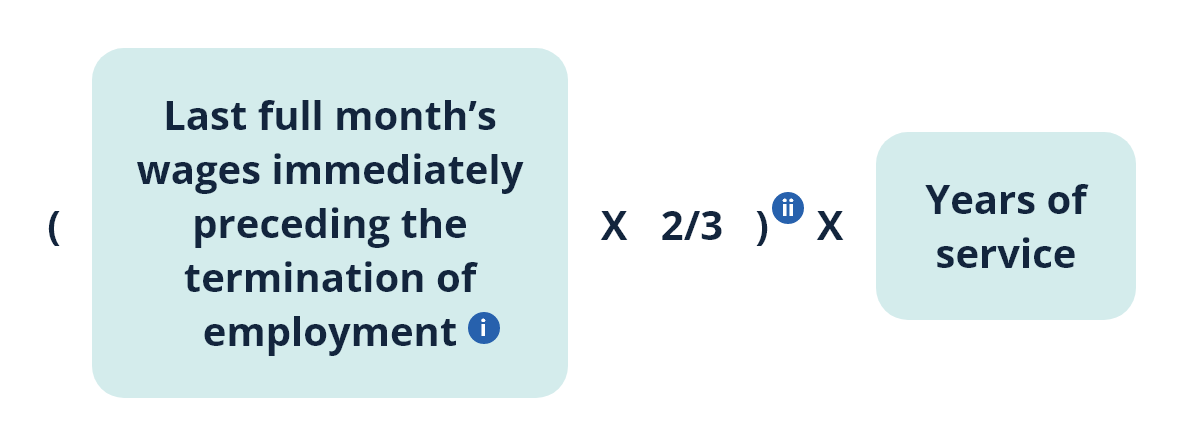

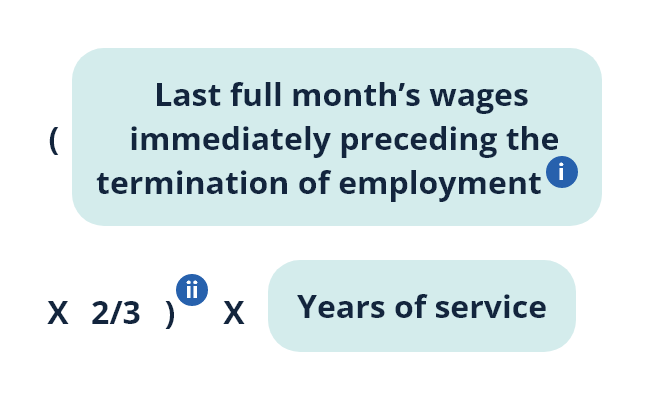

Calculation of severance payment (SP) / long service payment (LSP) is the same as the current calculation, i.e. calculated on the basis of the last full month’s wages immediately preceding the termination of employment

-

Cannot be offset by employers’ MPF mandatory contributions (ERMC)

Zoom

Zoom

-

The employee retains the full amount of SP/LSP (i.e. $60,000)

-

The employee retains the full amount of ERMC (i.e. $50,000)

-

The employee’s aggregate benefits

= SP/LSP + ERMC

= $60,000 + $50,000

= $110,000

(The above figures are for illustrative purpose only.)

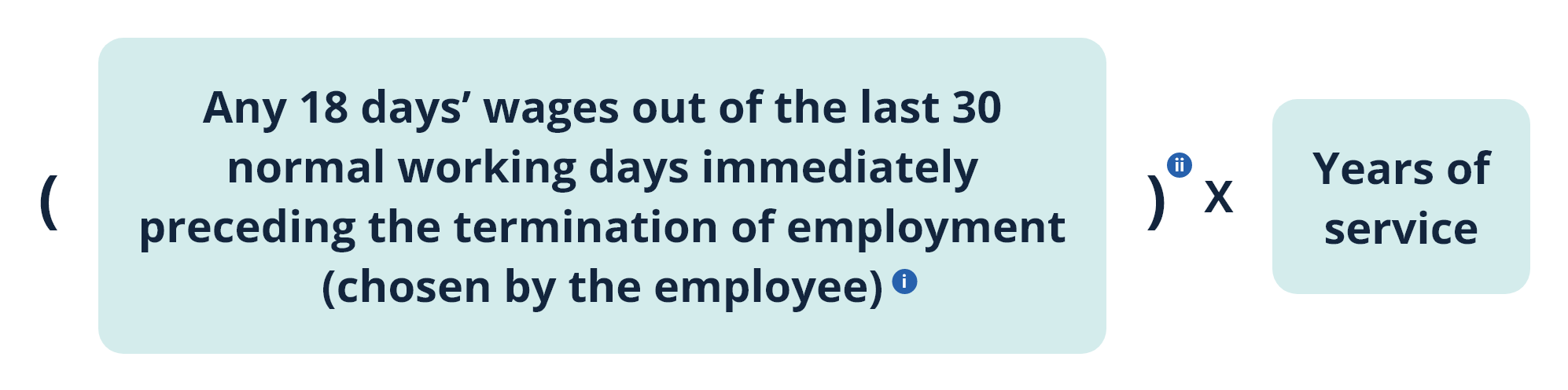

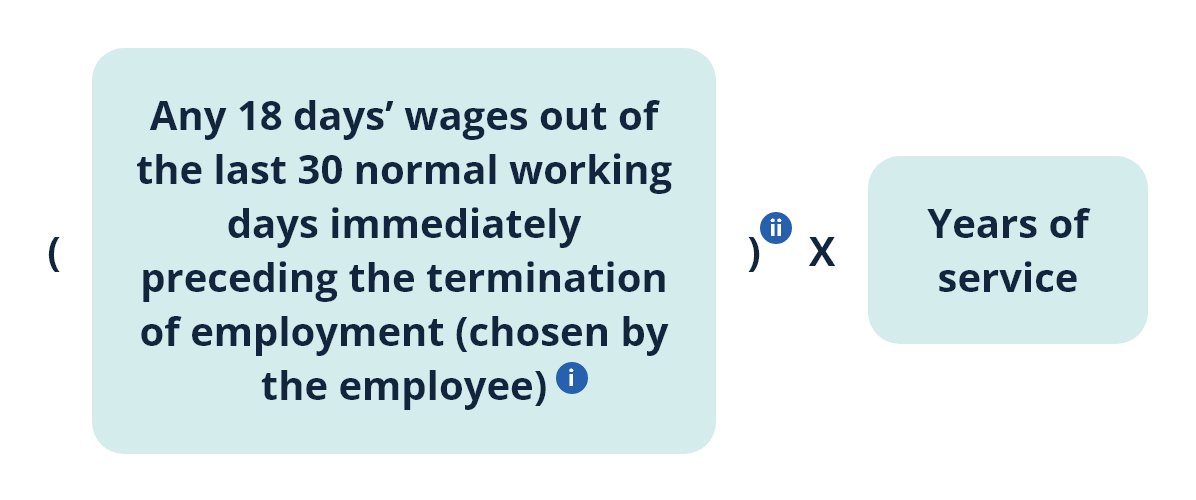

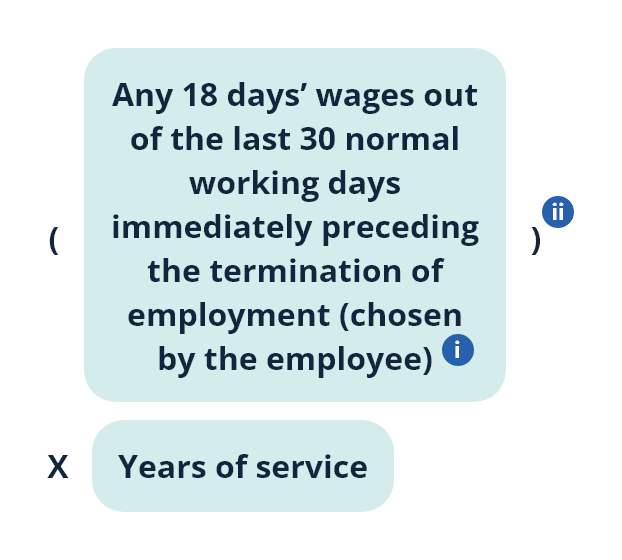

Calculation of SP/LSP

-

The maximum amount of SP/LSP is $390,000.

An employee may also select to use his/her average monthly wages over the last 12 months immediately preceding termination of employment for the calculation.

The sum should not exceed 2/3 of $22,500 (i.e. $15,000).

An employee may also select to use 18 times of his/her average daily wages over the last 12 months immediately preceding termination of employment for the calculation.

The sum should not exceed 2/3 of $22,500 (i.e. $15,000).