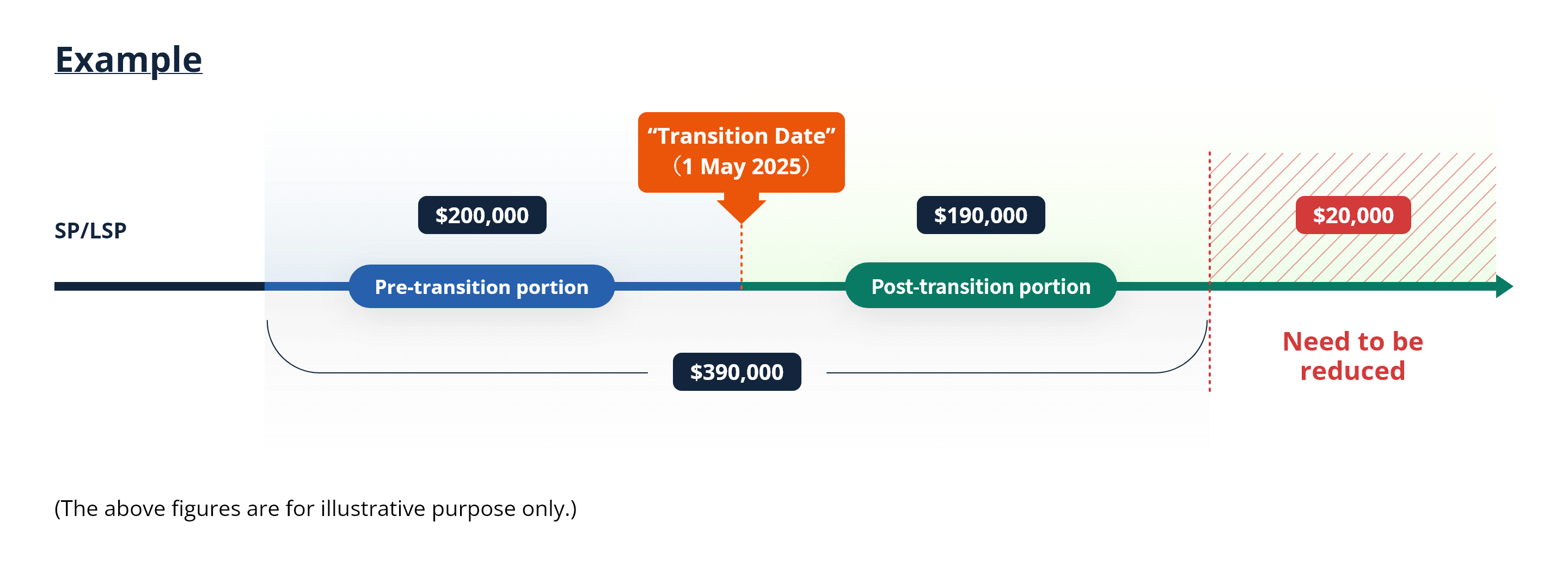

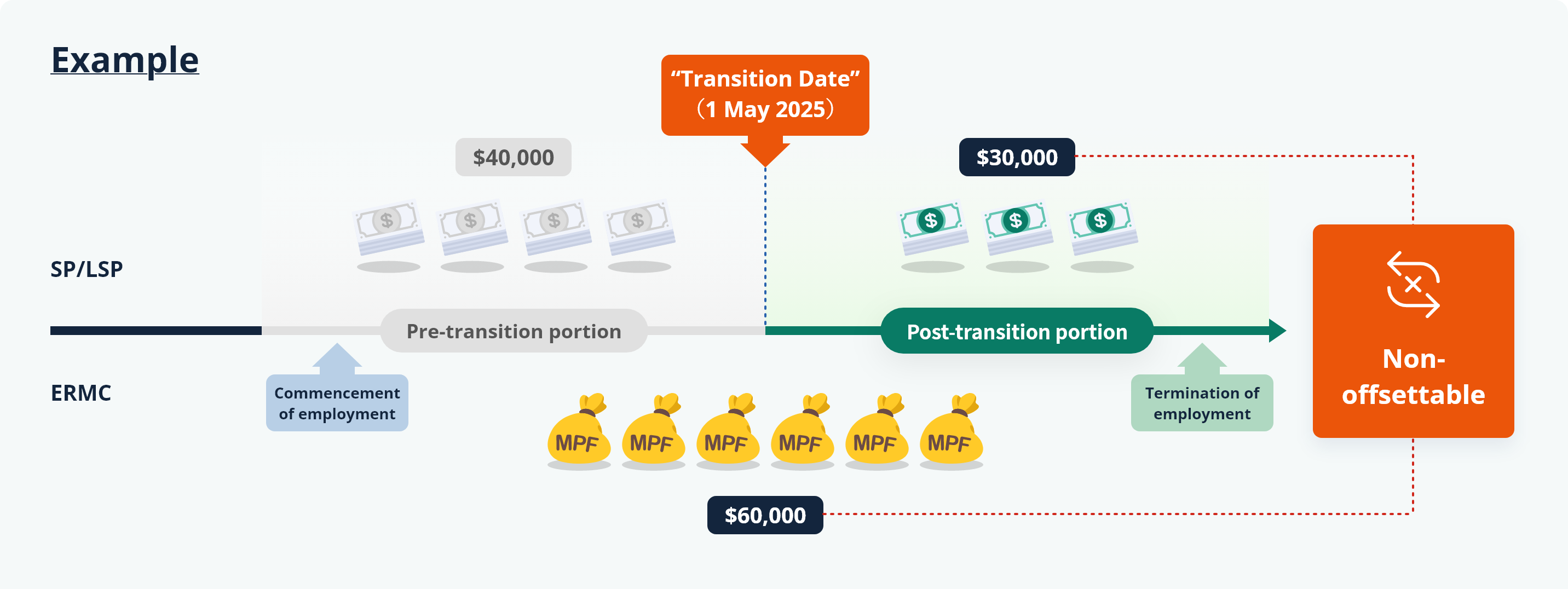

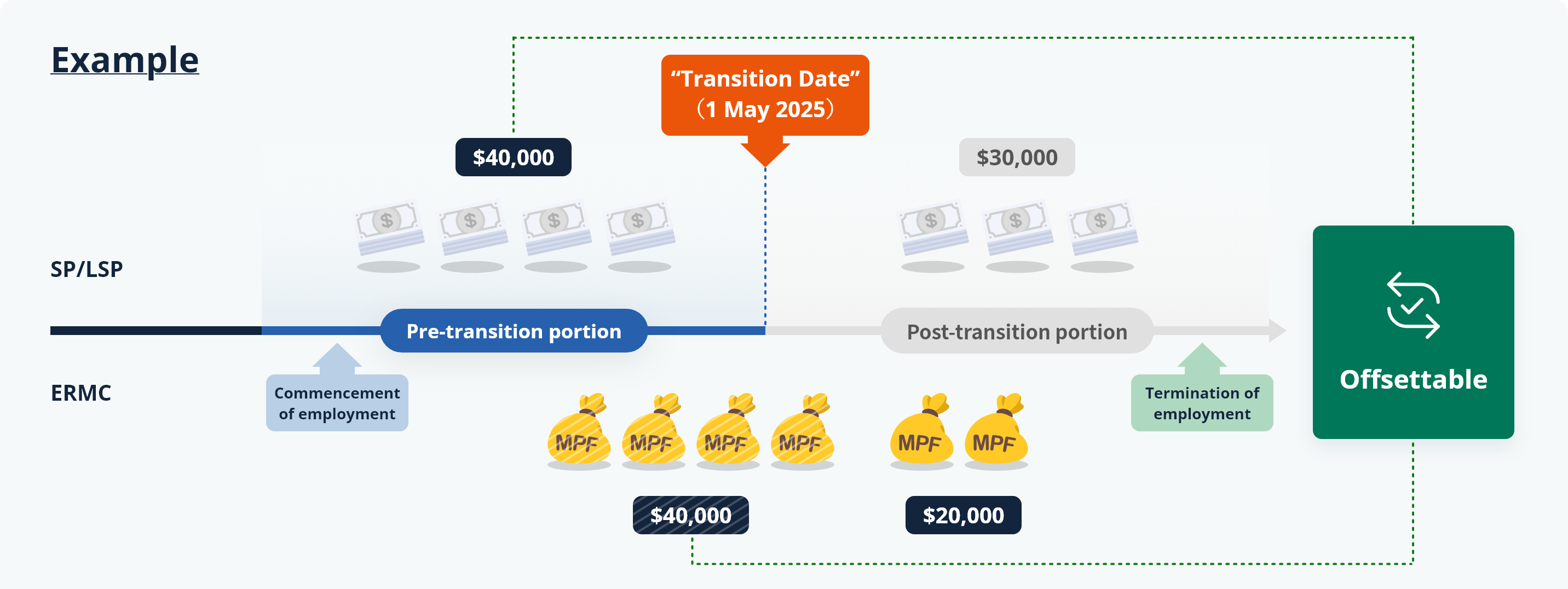

Severance payment (SP) and long service payment (LSP) is divided into two portions by the “transition date” – the pre-transition portion (i.e. the employment period before the “transition date”) and post-transition portion (i.e. the employment period starting from the “transition date”).

Post-transition portion

-

The calculation is the same as the current calculation, i.e. calculated on the basis of the last full month’s wages immediately preceding the termination of employment

-

Cannot be offset by the accrued benefits derived from the employers’ mandatory MPF contributions (ERMC)

Zoom

Zoom

-

The employee retains the full amount of post-transition portion of SP/LSP (i.e. $30,000)

(The above figures are for illustrative purpose only.)

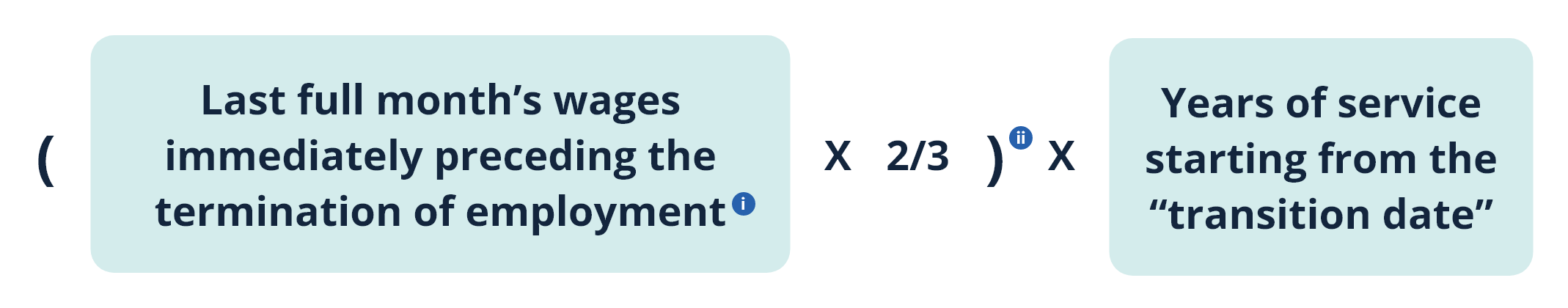

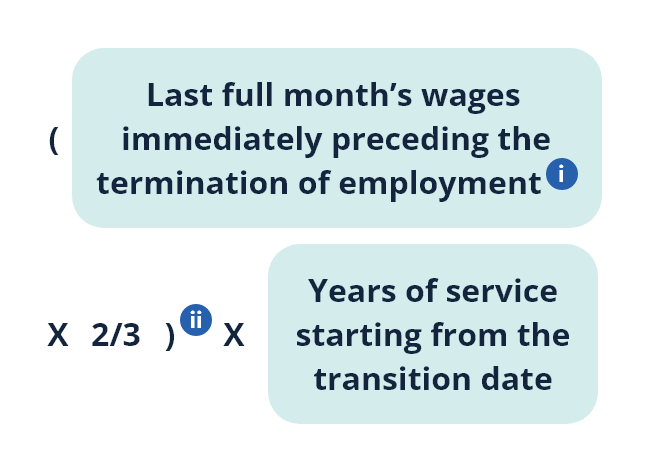

Calculation of post-transition portion of SP/LSP

-

Calculated on the basis of the last full month’s wages immediately preceding the termination of employment

An employee may also select to use his/her average monthly wages over the last 12 months immediately preceding termination of employment for the calculation.

The sum should not exceed 2/3 of $22,500 (i.e. $15,000).

An employee may also select to use 18 times of his/her average daily wages over the last 12 months immediately preceding termination of employment for the calculation.

The sum should not exceed 2/3 of $22,500 (i.e. $15,000).

Pre-transition portion

-

Calculated on the basis of the last full month’s wages immediately preceding the “transition date”

-

Can continue to be offset by ERMC

Zoom

Zoom

-

The employee retains the full amount of pre-transition portion of SP/LSP (i.e. $40,000)

-

The employee retains the remaining ERMC after offsetting (i.e. $20,000)

-

The employee’s aggregate benefits

= Pre-transition portion of SP/LSP + Post-transition portion of SP/LSP + ERMC retained after offsetting

= $40,000 + $30,000 + $20,000

= $90,000

(The above figures are for illustrative purpose only.)

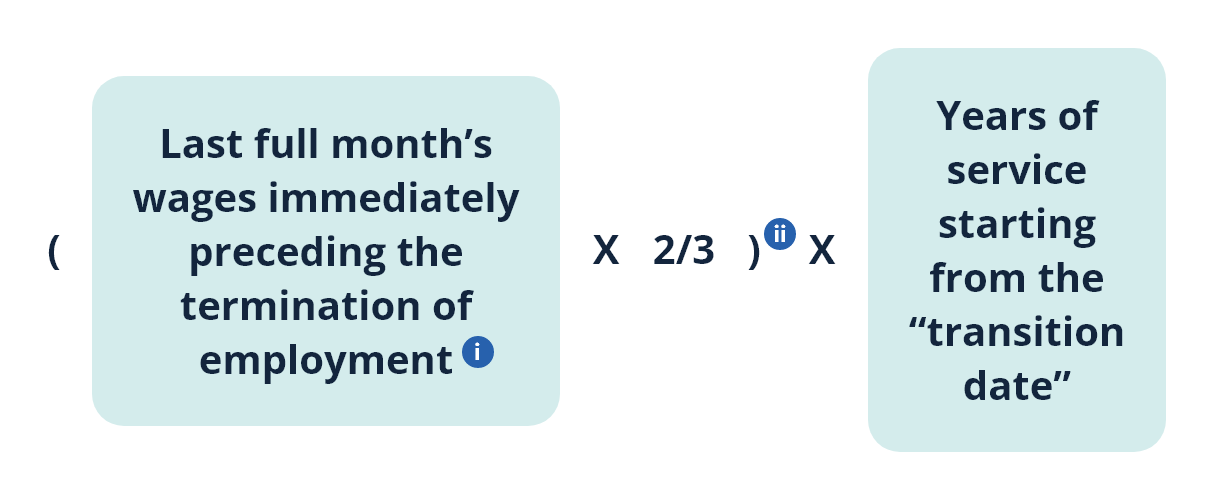

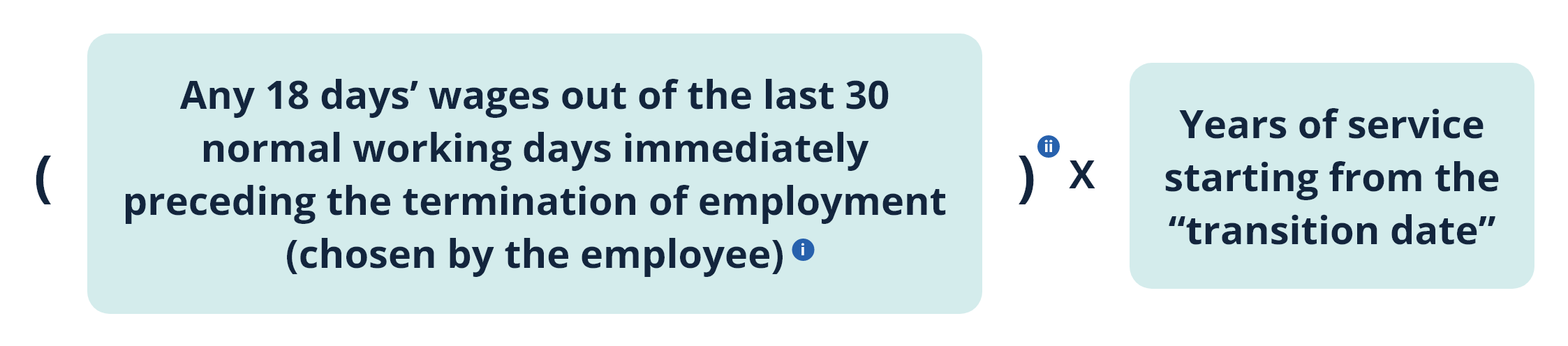

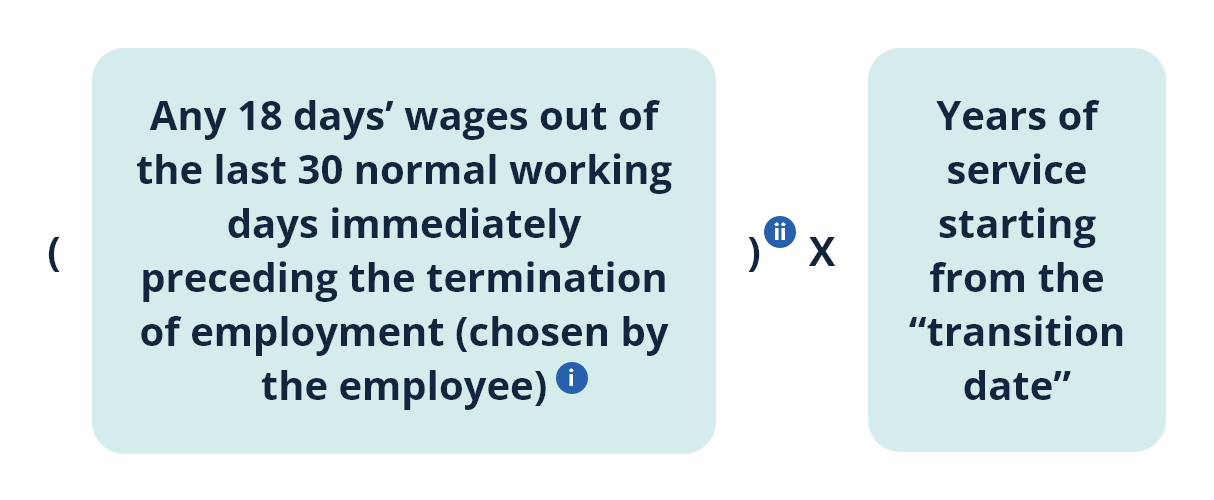

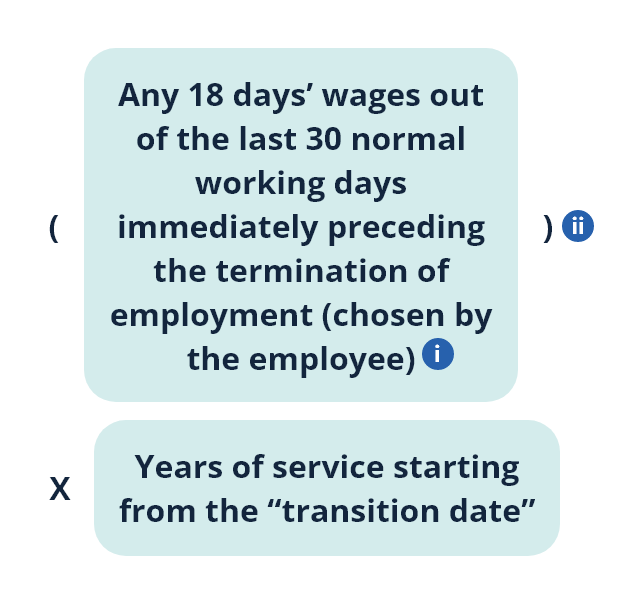

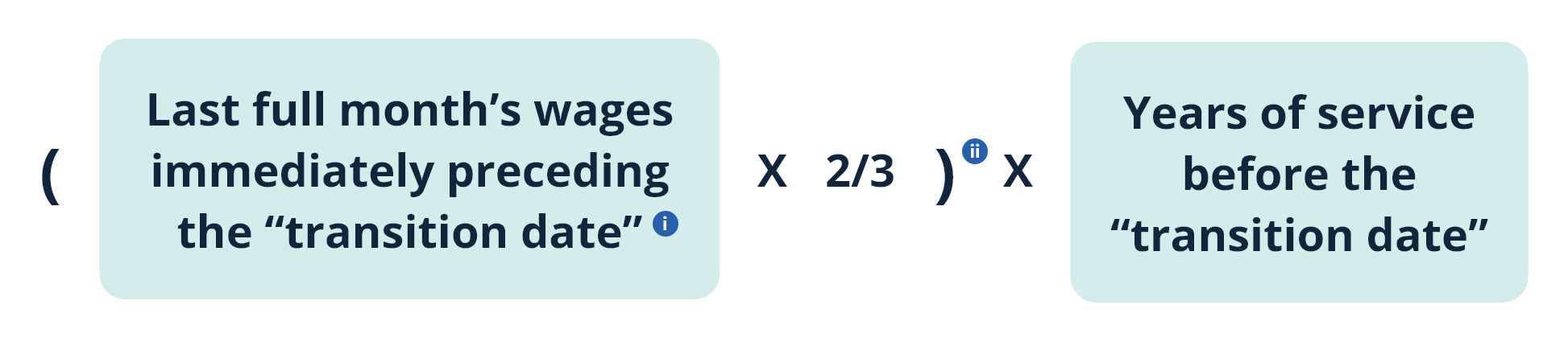

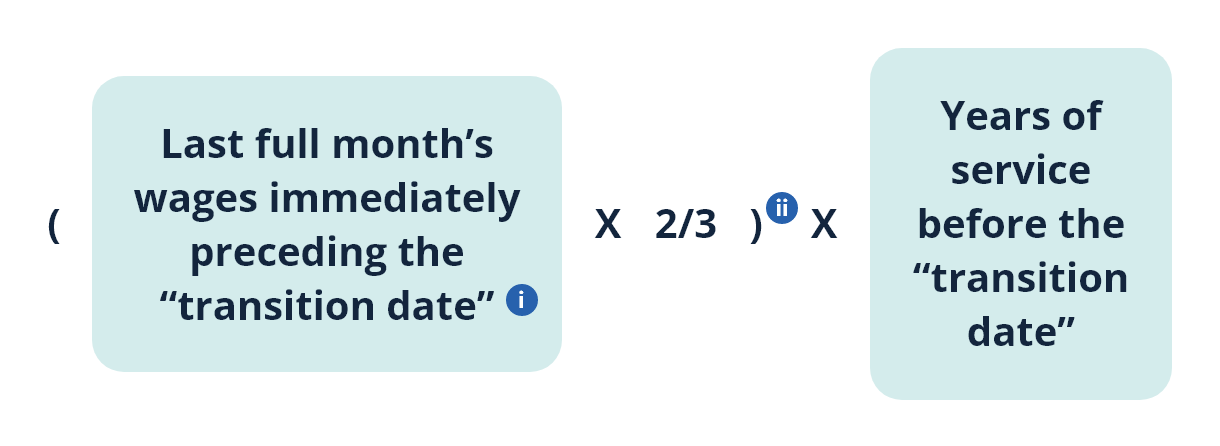

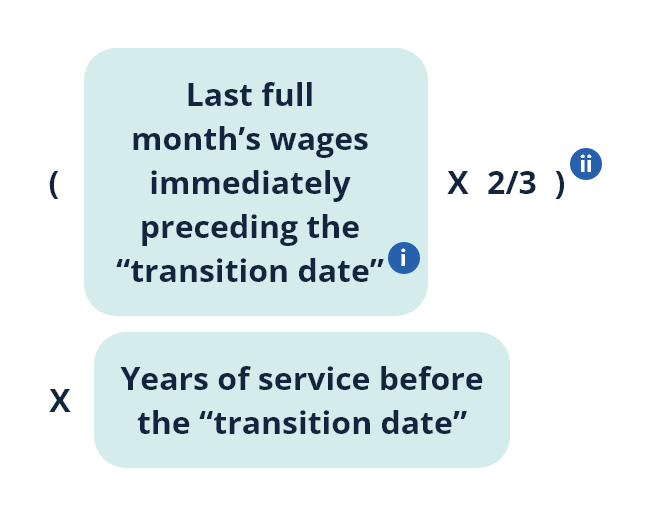

Calculation of pre-transition portion of SP/LSP

-

Calculated on the basis of the last full month’s wages immediately preceding the “transition date”

- An employee may also select to use his/her average monthly wages over the last 12 months immediately preceding 1 May 2025 for the calculation.

-For employment period preceding 1 May 2025 less than 12 months, average monthly wages for the employment period before 1 May 2025 may be selected for the calculation.

- For employment period preceding 1 May 2025 less than 1 month, the first full month’s wages after commencement of employment will be used for the calculation.

The sum should not exceed 2/3 of $22,500 (i.e. $15,000).

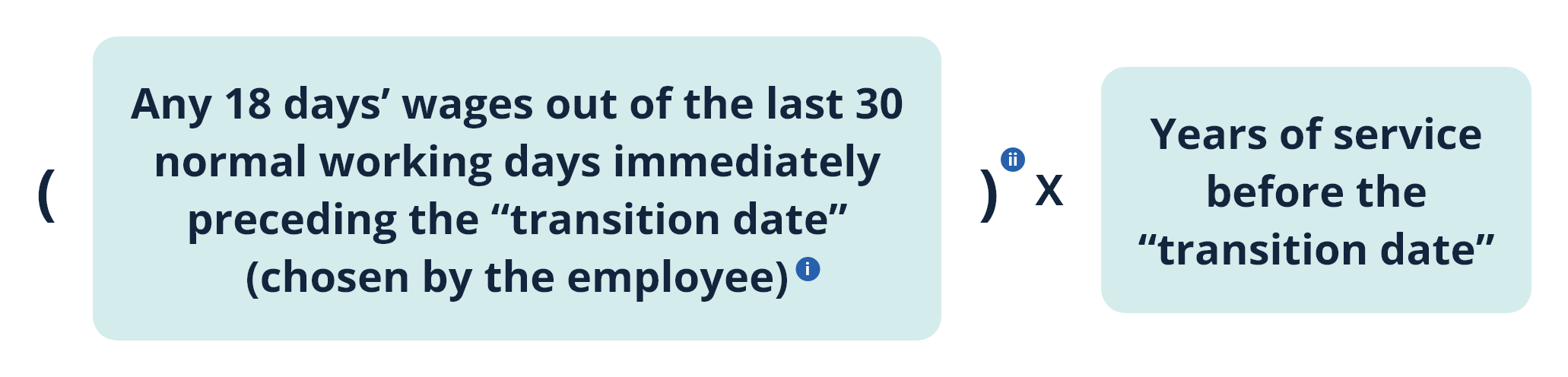

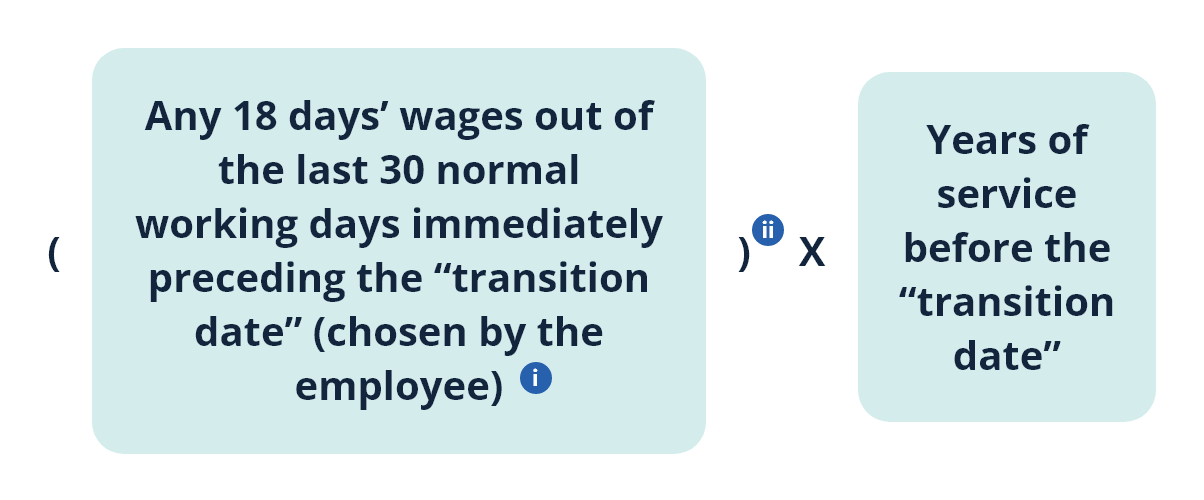

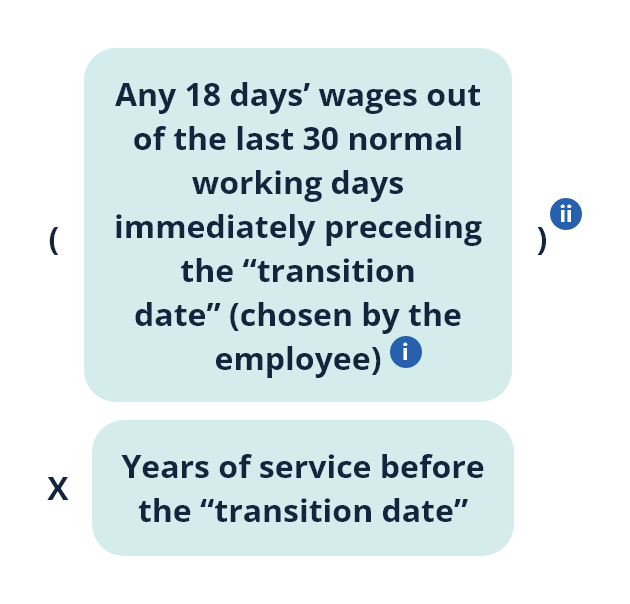

- An employee may also select to use 18 times of his/her average daily wages over the last 12 months immediately preceding 1 May 2025 for the calculation.

- For employment period preceding 1 May 2025 less than 12 months, 18 times of average daily wages for the employment period before 1 May 2025 may be selected for the calculation.

- For employment period preceding 1 May 2025 less than 30 normal working days, 18 days’ wages chosen out of the first 30 normal working days after commencement of employment will be used for the calculation.

The sum should not exceed 2/3 of $22,500 (i.e. $15,000).

If the total SP/LSP exceeds $390,000

-

The maximum amount of total SP/LSP remains at $390,000.

-

If the sum of the pre- and post-transition portions of SP/LSP exceeds $390,000, the amount in excess is to be deducted from the post-transition portion.