-

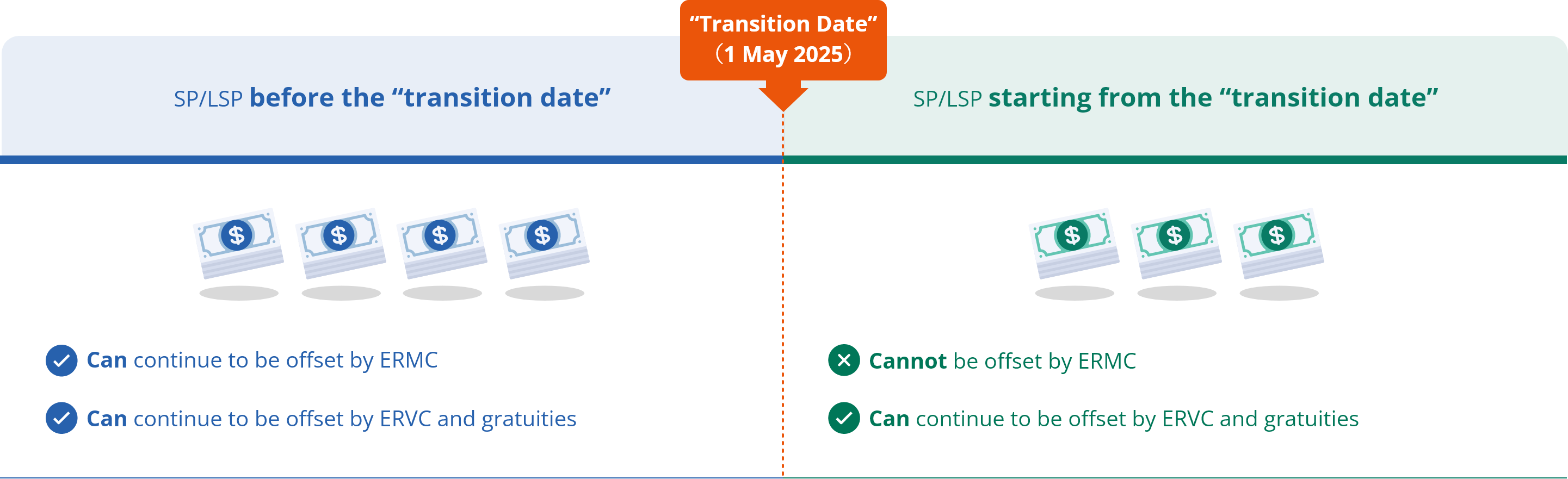

1 May 2025 is the “transition date”, i.e. the date that the abolition takes effect.

-

After the abolition comes into effect:

-

The accrued benefits derived from employers’ MPF mandatory contributions (ERMC) cannot offset employees’ severance payment (SP) and long service payment (LSP) in respect of the years of service starting from the “transition date”, but can continue to offset the employees’ SP/LSP in respect of the years of service before the “transition date”.

-

The accrued benefits derived from employers’ MPF voluntary contributions (ERVC) and gratuities based on employees’ years of service can continue to offset employees’ SP/LSP (irrespective of the years of service before or after the “transition date”).

-

Application of the arrangements

The arrangements are not applicable to employees who are not covered by the MPF System or other statutory retirement schemes (including domestic helpers, and employees aged less than 18 or over 65). As employers are not required to make MPF mandatory contribution for such employees, these employees are not affected by the abolition of the offsetting arrangement. Their SP/LSP will continue to be calculated on the basis of the last month’s wages or the average wages in the 12 months immediately preceding the termination of employment in accordance with the existing provisions under the Employment Ordinance.